Reading time: 7 minutes

Published: January 14, 2025

Modified: August 23, 2025

Introduction

Growing up, I was enamored with the TV game show Let’s Make a Deal. Contestants would often gamble what they had already won for the potential of something bigger and better, which reminded me of the phrase, “A bird in the hand is worth two in the bush.” Beyond the costumes and quirky trades, there are surprising lessons from Let’s Make a Deal about risk, decision-making, and the biases that shape our financial choices.

At its core, Let’s Make a Deal wasn’t just about the prizes—it was one big advertising commercial! Everything, from cars and furniture to jewelry and household appliances, was a plug for the latest products. And, of course, who could forget the zip code for Spiegel ↗ in Chicago, Illinois: 60609? It’s burned into my memory forever!

The more I watched the show, the more I started to notice patterns. For instance, boxes brought into the audience and placed on a pedestal were usually good bets—trading cash for “what’s under the box” often paid off.

But choosing between the famous (infamous?) three doors during the show always felt like a toss-up. Yet, there’s a deep mathematical insight in that final choice that holds an important lesson for how we handle our finances—it’s called the Monty Hall problem, named after the co-creator and long-time host of Let’s Make a Deal.

Explaining the Monty Hall Problem

I’ve always been fascinated by the Monty Hall problem and have been pondering what lessons could be learned from it in the realm of personal finance. During the show, a selected contestant faced the choice of three doors: #1, #2, and #3. Only one door concealed the grand prize, while the others held lesser rewards.

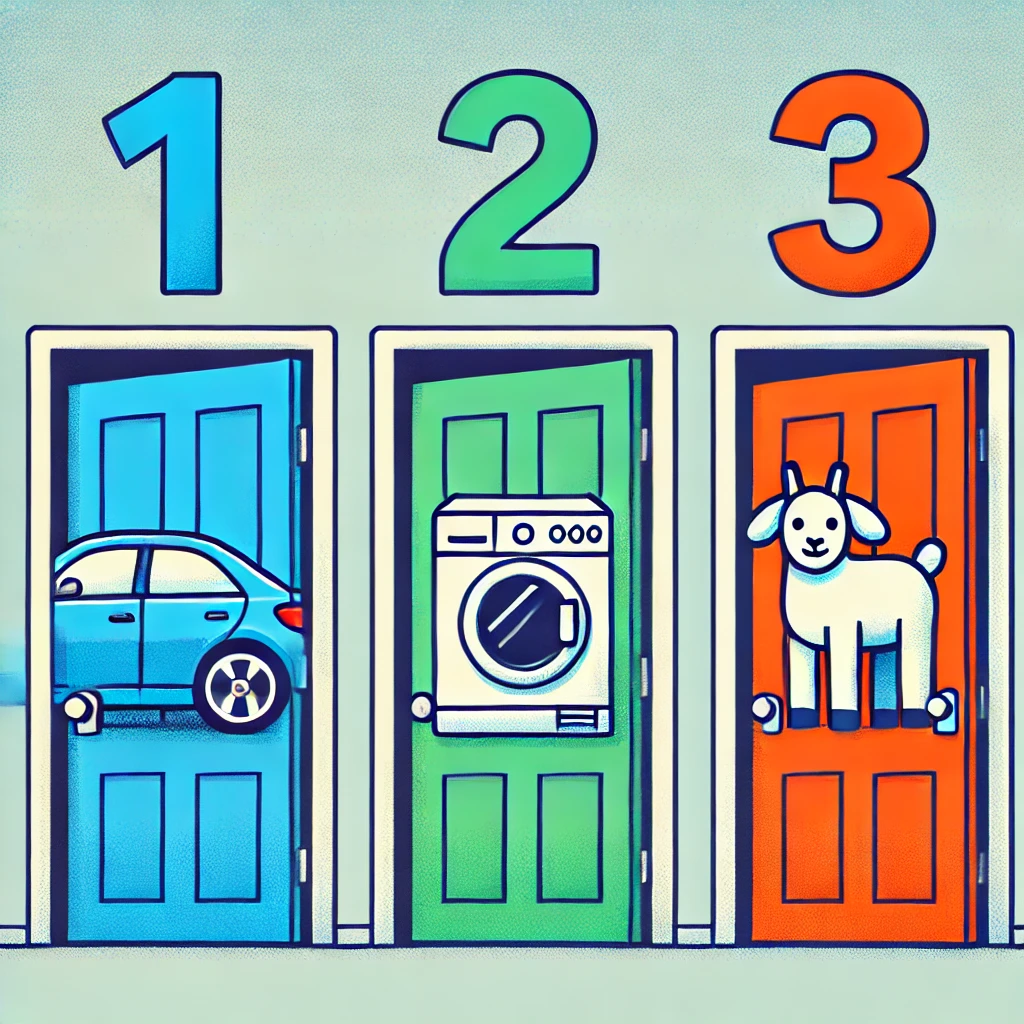

As seen in the illustration above, let’s imagine:

- Door #1 has the grand prize—a brand-new car.

- Door #2 has a nice prize, like a new washer and dryer.

- Door #3 has what’s considered a dud prize called a zonk, like a live goat, though dud is subjective, isn’t it?

The contestant is asked to pick one of the three doors and chooses door #3. Monty, knowing what’s behind each door, reveals door #2 to reveal the modest prize that the contestant could have won—in this case, the washer and dryer.

Now comes the gut-wrenching decision the contestant has to make. Monty asks, “Do you want to stick with door #3 or switch to door #1?”

The contestant’s initial odds of selecting the grand prize are 1/3. At first glance, it might seem like the odds improve to 1/2 (or a 50/50 chance) after Monty reveals door #2—after all, only two doors remain.

But here’s the twist: switching doors actually increases the odds of winning the grand prize from 1/3 to 2/3. Why? Because Monty’s reveal transfers the probability of success from the eliminated door to the remaining one. The math may be counterintuitive, but it’s solid. (Yes, oftentimes sticking with same door awarded the contestant the grand prize, but I’m discussing probabilities here.)

Making It Clear: The Million-Door Example

To see why switching is the smarter move, imagine the game starts with a million doors. You pick one—door #348,971—and Monty, knowing the grand prize is behind door #578,222, shows you what’s behind the other 999,998 doors that do not contain the grand prize. Now, only two remain: your initial pick and Monty’s choice.

Do you stick with your original pick or switch? The odds of your initial pick being correct are still 1 in a million, but the odds of Monty’s chosen door being correct are 999,999 in a million. Obviously, you switch.

The Role of Monty’s Knowledge in the Game

It’s important to note that the analysis of the Monty Hall problem depends entirely on Monty knowing what’s behind each door. His deliberate reveal of a non-winning option (door #2) is what shifts the probabilities. If Monty were randomly opening doors without this knowledge, the entire structure of the problem—and the resulting probabilities—would change. For instance, if Monty accidentally revealed the grand prize, the advantage of switching would disappear entirely.

Personal Finance Lessons from Monty Hall

The Monty Hall problem isn’t just a fascinating mathematical puzzle—it’s a framework for thinking about decision-making, probabilities, and flexibility. In personal finance, much like in the game show, we often face choices with incomplete information. The key is to understand when to stick with your initial decision and when to adapt as new information becomes available.

Here are some important lessons that this game show paradox can teach us about managing money wisely:

Reevaluating Choices with New Information

Financial decisions often begin with incomplete information—whether it’s choosing an investment or buying a home. As more data becomes available (like Monty revealing door #2), it’s essential to reassess your options. Sticking with your initial choice might feel comfortable, but being flexible often leads to better outcomes.

For example, say you invested in a stock, and new data suggests its growth prospects are dim. The Monty Hall mindset would encourage you to reevaluate and potentially “switch” to a better-performing stock or asset class.

Overcoming Cognitive Biases

Humans are naturally drawn to their initial decisions, and the Monty Hall problem highlights how this tendency can influence choices. People often overvalue their first pick, simply because it feels like it’s already “theirs.” Sticking with the original decision also feels safer, even when new information suggests switching would lead to better outcomes.

Another common behavior is the tendency to avoid regret by preferring inaction over action. Contestants—and investors—often fear that switching could lead to a mistake, even when the odds favor a change. This hesitation can lead to missed opportunities.

The Monty Hall problem reminds us that staying with the status quo isn’t always the best strategy. By reassessing your choices when new information becomes available, you can make decisions that are more rational and potentially more rewarding.

Adjusting to Changing Market Conditions

Just as Monty’s reveal changes the probability of where the grand prize is, market shifts can change the potential return of investments. Rebalancing your portfolio or exploring new opportunities after reviewing current conditions is akin to switching doors.

Holding onto an initial investment might feel safe, but as the financial landscape evolves, the odds of success for certain assets may shift dramatically. Staying informed and flexible allows you to adjust your strategy to align with the new probabilities.

For example, an asset class that once seemed like a “sure bet” might lose its appeal as economic conditions change, while other investments might become more promising. Just as switching doors in the Monty Hall problem increases your chances of winning, reallocating your investments based on updated information can improve your likelihood of achieving financial goals. The key is to stay proactive and avoid becoming complacent with your original choices.

Conclusion: Embracing Flexibility in Finance

The Monty Hall problem and the strategies from Let’s Make a Deal are more than just game-show trivia—they’re a lens through which we can view our own financial decisions.

If you’re looking to further improve your decision-making, check out Top Investing Mistakes to learn how to avoid common pitfalls and make smarter money moves. By applying these insights, you can outsmart your money biases and make smarter financial choices, one “door” at a time.