Reading time: 3 minutes

Published: September 2, 2024

Modified: March 27, 2025

When it comes to building wealth, the power of compounding is one of the most powerful forces at your disposal. To illustrate just how impactful it can be, let’s consider a simple, yet eye-opening scenario.

Key Takeaways

- This example illustrates the incredible potential of compounding.

- Start early, be patient, and let your money work for you over time.

- Small, consistent growth can lead to unimaginable wealth, thanks to the exponential power of compounding.

Compounding Example

Imagine you’re given two options: Option 1 offers you $5,000 per day for 40 days straight. By the end, you’d have a hefty $200,000 in your pocket—an impressive sum! Option 2, however, starts with just a single penny on day 1, but that penny doubles every day for 40 days. Realistically, you’d be hard-pressed to find an investment that returns 100% daily for 40 days, but let’s suspend disbelief for now!

At first glance, $5,000 a day seems like the clear winner, right? But let’s look closer at Option 2 and the power of compounding.

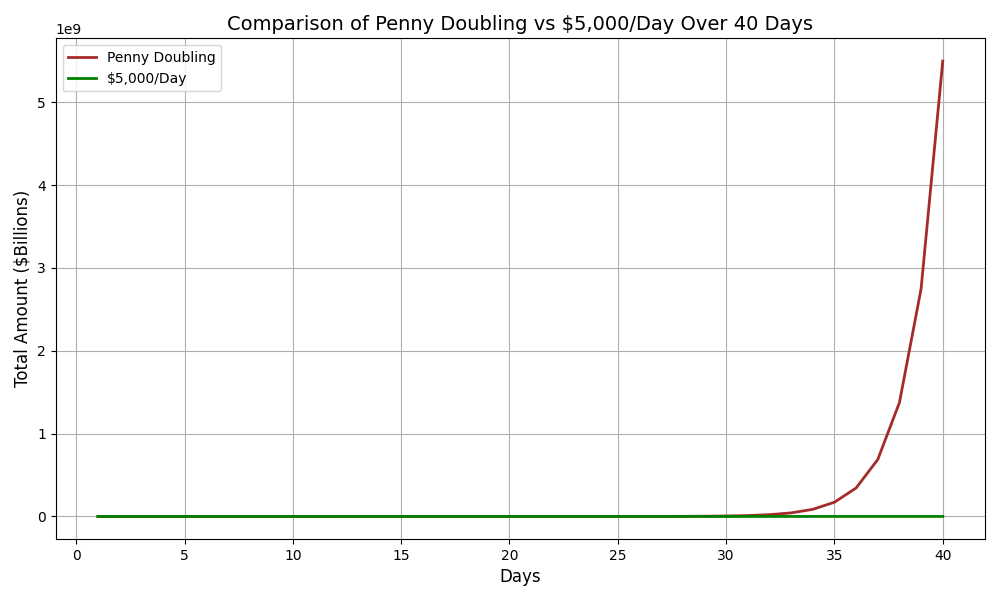

On day 1, you start with just $0.01. On day 2, you have $0.02. By day 10, you’re still only at $5.12—hardly enough to get excited about. However, as you continue to double your money every day, the growth becomes exponential. By day 20, you’ve reached $5,242. And here’s where the magic of compounding really kicks in: by day 30, you have $5,368,709. When you reach day 40, the total is an astonishing $5,497,558,138!

That’s right—by choosing to start with a penny and doubling it every day, you end up with over $5.4 billion, compared to the $200,000 you’d have with the first option.

The graph below clearly illustrates the power of compounding over time. Note that the vertical axis is in billions. Relative to a billion dollars, both options perform similarly up to around day 33. Thereafter, the value of the penny doubling option takes off exponentially.

In your financial journey, harnessing the power of compounding can transform modest investments into significant wealth. So, whether you’re saving for retirement, building an emergency fund, or investing in the stock market, remember: time and consistency are your best friends.

If you’re not convinced by me, take it from Albert Einstein. It’s said that he called compound interest the eighth wonder of the world: “He who understands it, earns it. He who doesn’t, pays it.”

As you consider your financial goals, remember that consulting with a financial or tax advisor can help you tailor strategies that make the most of the power of compounding in your own life.

For more information about compounding, see Compound Annual Growth Rate (CAGR): Evaluating Investment Returns.