Reading time: 9 minutes

Published: October 15, 2024

Modified: December 31, 2024

If your Medicare premiums are projected to go up due to an Income-Related Monthly Adjustment Amount (IRMAA), you may be eligible for a reduction. This quick guide will show you how you might be able to reduce your IRMAA payments this year by submitting the SSA-44 form and providing key documents to the Social Security Administration (SSA).

Key Takeaways

- If your income has decreased due to a life event, submit SSA-44 with proper documentation.

- The SSA will use supporting documentation that you provide and your tax returns to assess your income.

- If eligible, IRMAA reductions will be applied retroactively.

Recap of IRMAA

As described in my blog, IRMAA Uncovered: Beware of the Medicare Premium Surcharge!, IRMAA is a surcharge that higher-income beneficiaries must pay in addition to their standard Medicare Part B (medical insurance) and Part D (drug coverage) premiums. IRMAA is calculated based on your modified adjusted gross income (MAGI) from two years prior. MAGI is the sum of your adjusted gross income (AGI) and any tax-exempt interest.

So, if you’re going to start Medicare at age 65, your Part B and Part D premiums could increase based on your MAGI at age 63 (you will receive a notice in the mail if this is the case). However, it wouldn’t be uncommon for your MAGI at age 65 to be less than it was at age 63—for example, due to retirement or reduced work hours at age 65. In this case, any increase in your Medicare premiums would be an additional hardship financially since your income has decreased.

If the SSA determines that you are subject to IRMAA, they will contact you with the amount of the IRMAA and the tax year they used to compute it. They also provide a list of certain situations called life-changing events in which your IRMAA can be reduced.

Understanding the SSA-44 Form

The key to reducing your IRMAA is deciding if any of the life-changing events as described in the SSA-44 form applies to you. You can find the official SSA-44 form Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event ↗ on the SSA website.

Qualifying life-changing events can apply to you or your spouse and include:

- Marriage or divorce

- Death of a spouse

- Work stoppage or reduction

- Loss of income-producing property

- Loss of pension

- Employer settlement payment

In addition, if you filed an amended return two years ago with a MAGI lower than the MAGI supplied by the IRS to the Social Security administration, you might consider filing form SSA-44.

In any case, if the reduction in your MAGI isn’t low enough to drop you into a lower IRMAA bracket, do not file the form.

Gathering the Right Documentation

When filling out the SSA-44, you’ll usually need to provide evidence of your life-changing event. This is where documentation becomes important. For example, if your event is a work reduction or retirement, you’ll need letters from your employer or pay stubs to show that your income has decreased.

Here’s a checklist of common documents:

- W-2 forms, tax returns, or pay stubs for income-related events

- Court documents for divorce

- Death certificates for the passing of a spouse

- Employer correspondence for work reduction or stoppage

If you do not have documented proof of a work reduction or stoppage, the SSA might accept your signed statement on the form as proof, under penalty of perjury. However, their process often requires additional proof, and the lack of documentation can result in delays or rejection.

Having the proper paperwork ready before filling out the form can speed up the process and reduce the chance of denial.

Filling Out the SSA-44: A Step-by-Step Breakdown

While the form is relatively straightforward, there are a few steps where clarity is important. Here’s a brief guide to completing the form:

- Step 1: Choose the life-changing event that applies to you. Be sure to select the correct option, as the SSA will focus on this when evaluating your request. You must provide the date of the life-changing event.

- Step 2: Select the tax year in which your income was (or will be) reduced due to your life-changing event and report your actual or estimated adjusted gross income (AGI) and tax-exempt income, which together make up your MAGI.

The year you choose must be more recent than the year the SSA used to determine your current IRMAA. Report one of the following:- The current year and your estimated income for the current year (also called the premium year), if your MAGI is projected to be less in the current year than it was last year.

- Last year and your actual income from last year, if your MAGI for the current year is higher than last year, but lower than the year used to calculate your IRMAA.

I’ve summarized the tax year to report in Step 2 based on the instructions on page 6 of the SSA-44 form ↗.

- Step 3: Only fill this section out if you expect your MAGI to be even lower in the year after the year you specified in Step 2, such that your IRMAA would further decrease. Otherwise, skip to Step 4.

- Step 4: Provide supporting documentation that proves your claim.

- Step 5: Sign the form and provide your address and a phone number where you can be reached.

Example SSA-44 Form

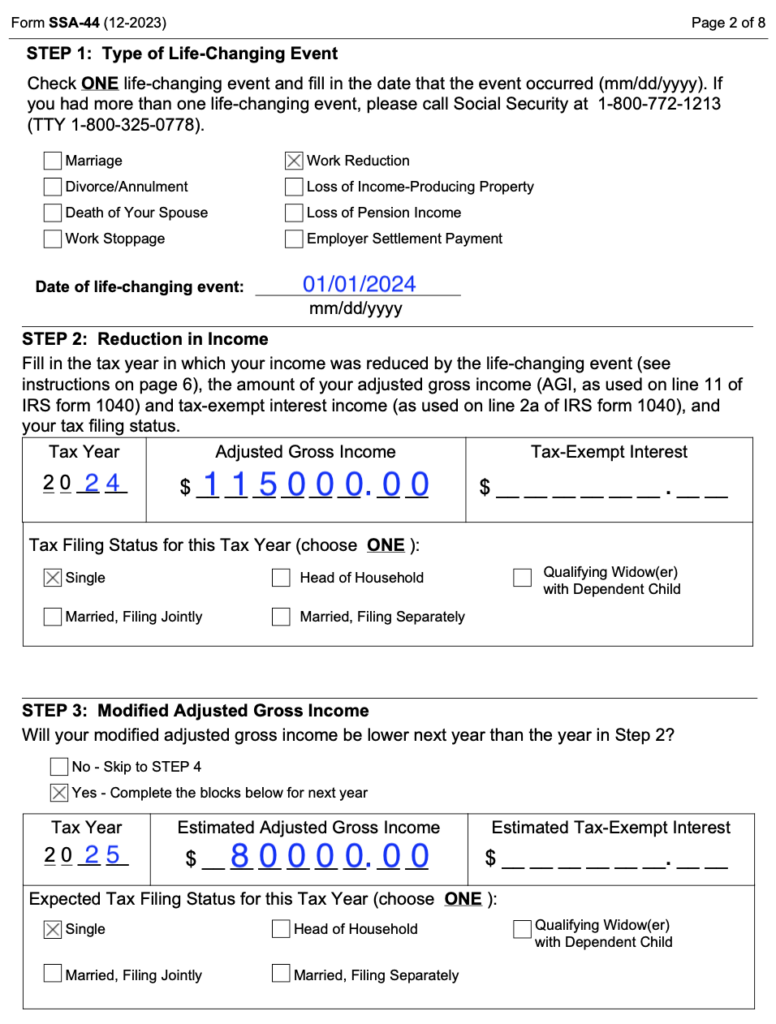

Let’s assume it’s 2024. Jane, a single individual, was fully employed in 2022 at age 63, with an AGI of $163,000. As of January 1, 2024, she began working part-time and expects her AGI to be $115,000 for 2024 and $80,000 for 2025. Jane has no tax-exempt interest, so her MAGI is the same as her AGI. She will enroll in Medicare for the first time in June 2024.

In March 2024, the SSA notifies Jane that her IRMAA for Medicare Part B and Part D will be $279.50 and $53.80, respectively, based on her 2022 MAGI.

For the IRMAA table relevant to your filing status, see the IRMAA Sliding Scale Tables ↗. These tables show the total premiums, which include both the standard premium and IRMAA.

Jane decides to submit the SSA-44 form because she expects her MAGI to significantly drop from 2022 through 2025. Here’s how she filled out Steps 1 through 3 on the form:

Based on the IRS’s sliding scale tables, Jane’s 2022 MAGI of $163,000 would put her in a bracket where her Part B IRMAA and premium would be $454.20; her Part D IRMAA would be $53.80 (plus her Part D premium, which varies based on the plan).

However, Jane’s estimated 2024 MAGI of $115,000 drops her into a bracket where her Part B IRMAA and premium will be $244.60; her Part D IRMAA will be $12.90 (plus her Part D premium).

This represents a monthly savings for her Part B and Part D plans of $209.60 and $40.90, respectively, for a total monthly savings of $250.50. Over the course of 12 months in 2024, that’s a huge savings of about $3,000. That’s what I call raining dollars, not just pennies!

Submitting Your Request and What Happens Next

Once the SSA-44 is complete and you’ve gathered all supporting documents, it’s time to submit your request. You can mail it to your local SSA office, submit it in person, or fax it. To find both the correct fax number and the address of your local Social Security office, visit Request to lower an Income-Related Monthly Adjustment Amount (IRMAA) ↗ and click on “Find a local office.” You’ll need to enter your zip code, and the system will provide both the fax number and the mailing address.

If you don’t have the supporting documentation ready, the Social Security Administration can instead look at your MAGI from your tax returns for the years you specified in Steps 2 and 3 of the form. If you estimated your income in Step 2, you might need to provide the SSA with a signed copy of the tax return you submitted to the IRS for the year you chose.

However, my research indicates that the SSA might check your MAGI on their own. I recommend that you call your local SSA office to determine whether you need to provide your tax return to them.

Once the SSA receives a copy of your tax return, they will review your case, which can take a few weeks. During this time, they may contact you for further clarification or additional documents.

If approved, your IRMAA reduction will be applied retroactively. To my knowledge, the SSA will mail you a check that represents the lump sum of the premium savings you’ve realized.

Submitting Additional Forms in the Future

If your income continues to decline, it may be necessary to submit additional SSA-44 forms in future years. An SSA representative advised me that you should file a new SSA-44 form with updated tax years if your income keeps dropping. For example, if your MAGI in 2026 is lower than it is in 2025, you would complete another SSA-44 form, using 2025 as the tax year in Step 2 and 2026 in Step 3.

This allows the SSA to reassess your IRMAA for the upcoming years, ensuring that your Medicare premiums reflect your most recent income. Keeping your records updated can help you avoid overpaying on your Medicare premiums as your financial situation changes.

What to Do If Your Request is Denied

If your request to lower your IRMAA is denied, don’t panic—you have the right to appeal. The appeal process involves requesting a reconsideration, which can be done through your local SSA office. You’ll need to provide additional information or documentation to support your claim.

Remember, even if your appeal is denied, you can request a new IRMAA reduction the following year if your income remains lower due to another qualifying event.

Navigating the IRMAA process can seem overwhelming, but understanding how to file the SSA-44 correctly and providing the right documents will give you the best chance at a successful request. For more detailed information on how IRMAA works, check out my blog post, IRMAA Uncovered: Beware of the Medicare Premium Surcharge!.

And remember, it’s always a great idea to chat with your financial or tax advisor to make sure your decisions are right on track and aligned with the latest guidelines and laws.